EU Taxonomy – New Reporting Requirements for Companies

What is the EU taxonomy?

I am often asked what the EU taxonomy is really all about. Much has been written about it and it can sometimes appear to be overwhelming. What follows is an attempt to put the various aspects of taxonomy into perspective, and I hope to make it a bit clearer to all and explain what Fichtner’s role is in this regard

The EU taxonomy is a dedicated system to classify which parts of the economy may be marketed as sustainable. It includes a range of economic activities, as well as detailed environmental criteria that each economic activity must meet to earn a green label. Previously, there was no clear definition of green, sustainable, or environmentally friendly economic activity.

The EU’s goal to eliminate its net emissions by 2050 requires huge investments. The EU taxonomy aims to make truly green activities more visible and attractive to investors by providing companies, investors, and policymakers with appropriate definitions for which economic activities can be considered environmentally sustainable. In this way, it should provide more certainty for investors, protect private investors from greenwashing, help companies to become more climate-friendly, mitigate market fragmentation and help shift investments to where they are most needed.

The rules classify three types of green investments.

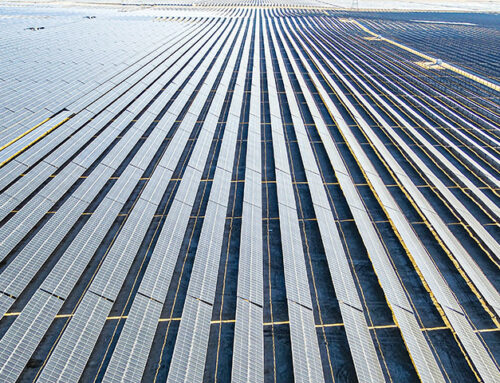

- First, those that substantially contribute to green goals, such as renewable energies including wind power farms, solar power developments, etc.

- Second, those that enable other green activities, such as facilities that can store renewable electricity or hydrogen.

- Third, transitional activities, which are defined by the EU taxonomy as “activities for which there are no technologically and economically feasible low-carbon alternatives, but that support the transition to a climate-neutral economy”.

The EU taxonomy provides a fixed framework for the concept of sustainability, exactly defining when a company or enterprise is operating sustainably or in an environmentally friendly manner. Compared to their competitors, these companies stand out positively and thus should benefit from higher attractiveness for investors. The legislation therefore aims to reward and promote environmentally friendly business practices and technologies.

What needs to be done?

Assessing the alignment of a company’s activities with the EU taxonomy consists of four main steps as presented in the following figure.

To be deemed green, an activity must substantially contribute to one of the following six environmental objectives and do no significant harm (DNSH) to the other five:

The first step of the taxonomy alignment assessment is to review a company’s activities and assess which of these are covered in the EU taxonomy. These activities are “eligible activities” according to the EU taxonomy and qualify for further screening. Next, the activity-specific requirements for the assessment in steps 2 and 3 are obtained from the regulation. It defines the technical screening criteria and thresholds. The requirements for the assessment in step 4 are defined by the OECD, UN, International Labor Organization, etc. Based on the requirements compiled, the data collection can start at the company and the degree of taxonomy alignment can be determined. The activities that fulfill the requirements of steps 2, 3 and 4 are then assessed as being “taxonomy-aligned”.

For non-financial undertakings, it is necessary to disclose the proportion of economic activities that align with the EU taxonomy criteria as follows:

- proportion of a company’s turnover derived from products or services with economic activities that are taxonomy-aligned

- proportion of a company’s operating expenditure (OPEX) spent on processes whose economic activities are aligned with the taxonomy

- proportion of a company’s capital expenditure (CAPEX) spent on assets whose economic activities are aligned with the taxonomy.

The following figure shows examples of outcomes of the taxonomy alignment assessment:

If measures are implemented to increase the taxonomy alignment level of a company, this will first affect the share of CAPEX that is taxonomy-aligned and, once the measures are operational, it will impact the shares of taxonomy-aligned turnover and OPEX.

A single plant (e.g. a wind farm) can, for example, be an asset of an industrial company or a utility. The plant could also be an individual company that is part of a fund. For single plants that are assessed as not being taxonomy-aligned, the reasons for this can be examined together with what action would need to be taken to achieve taxonomy alignment. For example, renewable energy installations may lack a climate risk and vulnerability analysis. To close the gap, this analysis can be subsequently prepared.

For new installations to be taxonomically aligned, the requirements set out in the regulation need to be considered at the design stage. This may include technical thresholds or additional studies which need to be carried out.

An excerpt of the activities that are eligible according to the taxonomy is given in the following figure:

Who is affected and when should EU taxonomy requirements be disclosed?

The following types of companies are requested to disclose to what extent their activities are aligned with the EU taxonomy:

- non-financial undertakings such as industrial enterprises and utilities, and

- financial undertakings such as asset managers, credit institutions, investment firms, and insurance / reinsurance undertakings.

The disclosure obligation is implemented in stages. Large companies that fall under the Non-Financial Reporting Directive (NFRD) are already subject to a reporting obligation. From 1 January 2025, companies that meet two of the following three criteria will be obliged to report: more than 250 employees, total assets of at least 25 million euros, net turnover of at least 50 million euros. The reporting deadline is in 2026. Smaller companies will be affected from 2026 (with reporting due in 2027, even if they have the option to opt out until 2028).

Even if companies are required to disclose their taxonomy alignment level only in the future, it is nevertheless important to start preparing the disclosure at an early stage, as this is a very comprehensive, complex, and time-consuming activity.

How does Fichtner assist in implementing the EU taxonomy?

EU taxonomy alignment will become a relevant characterization for infrastructures and businesses to demonstrate their sustainability. Fichtner has long-standing experience and knowledgeable professionals in the energy supply sector, which is subject to EU taxonomy. We regularly perform environmental as well as health and safety analyses for our clients and have been conducting climate risk assessments for hydropower for some decades now. This means that the building blocks are already in place at Fichtner. We understand the technologies and technical requirements, thresholds and measurement methods addressed in the technical screening criteria of the taxonomy regulation. In conjunction with our sector experts in the fields of Environmental & Health, Wind, PV, Hydro, Hydrogen, and Energy Economics, we have developed an approach for EU taxonomy alignment assessment. We are already helping clients find their way within this complex topic, and the potential products and services that we can offer to our clients are:

In addition to our broad portfolio, our expertise in key areas such as energy supply and climate risk assessment means that we at Fichtner are ideally equipped to support our clients in meeting the taxonomy requirements. We offer them tailored services to help them adapt to this new regulation and give them a competitive edge.

Although this has taken me longer to explain than I initially intended, I hope that the reader will still find this overview helpful. In my next article, I will be focusing on more specific aspects of taxonomy to round off the picture.

February 2024

Gareth Scott

Senior Consultant

in the project department Environment International